Offshore Company Formation Demystified: Critical Things to Learn

Exactly How Offshore Business Formation Works and Why It's Vital for Global Growth

Offshore Business Formation is a strategic method that allows companies to develop themselves in international jurisdictions. This process uses different benefits, including tax obligation optimization and boosted privacy. Understanding exactly how this functions is crucial for services intending for worldwide growth. The selection of jurisdiction plays a considerable role in the prospective success of such endeavors. What elements should be considered when choosing the right area for an overseas business?

Recognizing Offshore Business Formation

While numerous business owners look for chances past their domestic markets, comprehending overseas Business Formation is crucial for navigating the intricacies included. Offshore Business Formation describes the process of developing a business in an international jurisdiction, often for tactical advantages such as possession security, tax obligation optimization, and regulatory versatility. This procedure generally involves choosing an ideal territory, which can influence the ease of doing organization and conformity demands.

Entrepreneurs must also think about the legal structures, which differ greatly throughout countries, consisting of business administration frameworks and reporting responsibilities. Additionally, they need to browse prospective challenges such as language obstacles and cultural differences that may influence procedures.

Comprehending the effects of overseas Business Formation can aid business owners make informed choices, making sure that they straighten their Business objectives with the lawful and economic landscapes of the chosen territories. This foundational understanding is crucial for successful worldwide expansion.

Benefits of Developing an Offshore Company

Establishing an overseas firm offers various benefits that can boost Business operations and economic administration. Largely, it supplies access to positive tax routines, allowing services to lower their general tax burden and enhance success. This financial performance can free up sources for reinvestment and development.

Moreover, overseas firms usually benefit from improved privacy and discretion, protecting delicate Business information from public analysis. This can be specifically advantageous for entrepreneurs seeking to shield their copyright and proprietary modern technologies.

Additionally, an overseas entity can help with higher accessibility to global markets, allowing business to expand their operations and consumer base - Offshore Company Formation. Such growth can bring about enhanced income and brand acknowledgment on an international range

Finally, establishing an offshore firm can improve functional adaptability, allowing services to adapt swiftly to altering market problems and governing environments, eventually placing them for long-lasting success.

Secret Considerations for Choosing a Territory

Choosing the ideal jurisdiction for overseas Business Formation requires careful examination of different elements that can considerably influence a firm's operations. Trick considerations include tax obligation guidelines, as different jurisdictions use differing degrees of tax obligation incentives or obligations (Offshore Company Formation). In addition, the political and financial stability of a territory is critical; a secure atmosphere cultivates Business self-confidence and longevity. Lawful frameworks additionally play a considerable role; territories with durable lawful securities can guard a firm's possessions and copyright

An additional crucial element is the convenience of doing service, including the effectiveness of enrollment processes and continuous conformity requirements. Language and cultural compatibility can likewise affect functional effectiveness, especially for firms taking part in worldwide markets. Accessibility to financial and financial solutions is essential for assisting in deals. Inevitably, a comprehensive analysis of these considerations will make it possible for a firm to pick the most helpful territory for successful overseas click here for info Business development.

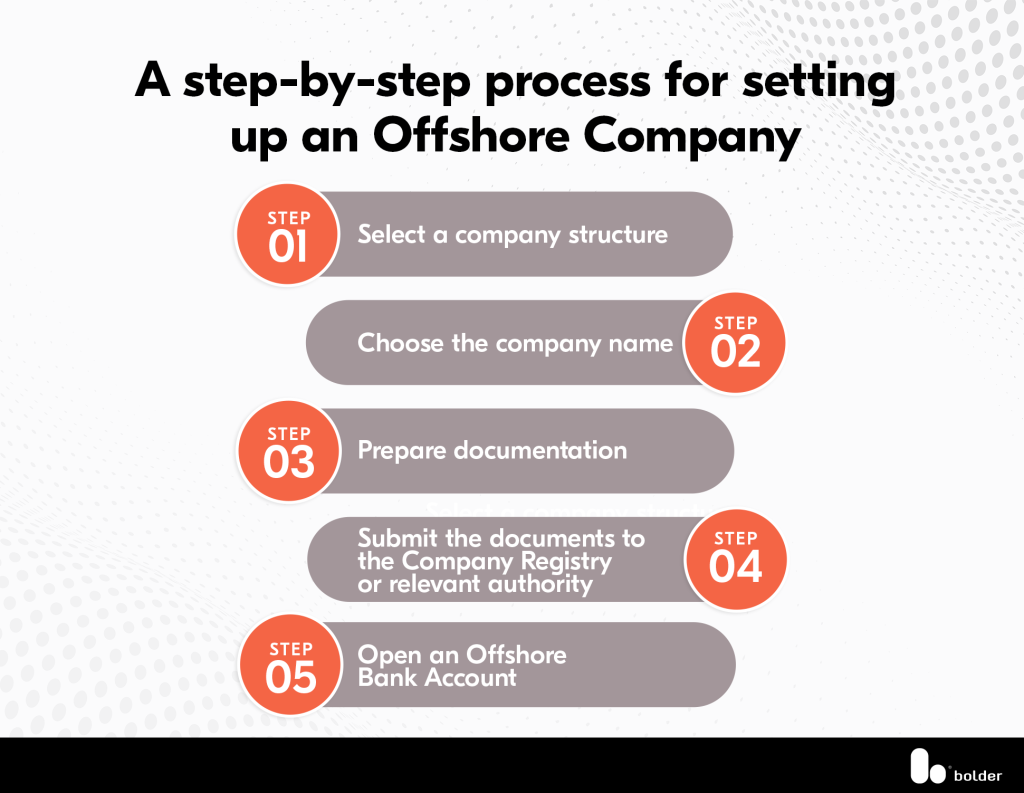

Steps to Set Up an Offshore Company

To efficiently establish an offshore business, a collection of methodical steps need to be followed to assure conformity and efficiency. Originally, company This Site owner should pick an ideal territory, taking into consideration factors such as taxation, personal privacy, and legal framework. Later, they should select a service framework, such as an LLC or firm, that lines up with their operational demands.

Next off, the required documentation has to be prepared, including short articles of consolidation, Business strategies, and identification for shareholders and supervisors. Following this, one must open a checking account in the selected jurisdiction, guaranteeing to accomplish any minimal deposit needs.

Furthermore, it's crucial to assign a registered representative to manage lawful correspondence. Company owners should establish a physical or digital workplace if necessary, finishing the arrangement process. By adhering to these steps, entrepreneurs can position their overseas businesses for effective international growth.

Navigating Lawful and Regulatory Demands

As soon as the fundamental steps for setting up an overseas Business are total, passing through the regulatory and legal requirements becomes necessary. Compliance with neighborhood regulations is important to avoid possible challenges that could jeopardize business's procedures. Each jurisdiction has its very own set of guidelines concerning tax, reporting, and company governance. Company owner must carry out complete research to comprehend these lawful frameworks.

Engaging local legal experts can offer very useful insights and help in maneuvering these complexities. They can aid guarantee adherence to anti-money laundering (AML) plans, tax responsibilities, and licensing requirements certain to the sector. In addition, comprehending global treaties and conventions is considerable for minimizing threats connected with dual tax and guaranteeing smooth cross-border deals. By focusing on lawful conformity, organizations can develop a reliable reputation and foster sustainable growth in worldwide markets, eventually causing effective worldwide development.

Regularly Asked Inquiries

What Are Usual Mistaken Beliefs About Offshore Business Formation?

Usual misunderstandings concerning offshore Business Formation include ideas that it is solely for tax evasion, discover here naturally illegal, or only for well-off people. Numerous ignore its legitimate uses for possession defense and global Business expansion.

Exactly how Do I Pick the Right Offshore Company?

Picking the best overseas solution copyright includes reviewing their experience, reputation, and compliance requirements. Furthermore, reviewing customer comments, service offerings, and responsiveness assurances placement with particular Business demands and boosts the total Formation experience.

Can I Open Up a Checking Account Remotely for My Offshore Company?

Yes, people can open up a checking account remotely for their overseas firm. Demands vary by jurisdiction, often demanding details paperwork and confirmation processes to guarantee conformity with regional and international financial regulations.

Neighborhood What Continuous Costs Should I Expect After Development?

After formation, recurring expenses usually include yearly charges for registration, audit services, tax obligation conformity, legal support, and prospective banking costs. These expenses can vary considerably relying on the jurisdiction and certain Business operational requirements.

Just How Can I Protect My Privacy When Developing an Offshore Company?

To protect personal privacy when creating an offshore company, individuals can utilize candidate services, develop trust funds, and choose jurisdictions with strong privacy regulations, ensuring very little public disclosure of possession and tasks while keeping compliance with laws. - Offshore Company Formation

Offshore Business Formation is a strategic method that enables business to establish themselves in international territories. Offshore Business Formation refers to the procedure of developing a firm in an international jurisdiction, frequently for tactical advantages such as possession security, tax optimization, and regulatory adaptability. Recognizing the effects of overseas Business Formation can help business owners make informed decisions, guaranteeing that they align their Business goals with the monetary and legal landscapes of the chosen territories. Developing an offshore company supplies countless benefits that can improve Business operations and economic administration. Choosing the right territory for offshore Business Formation calls for mindful examination of different aspects that can considerably affect a company's procedures.